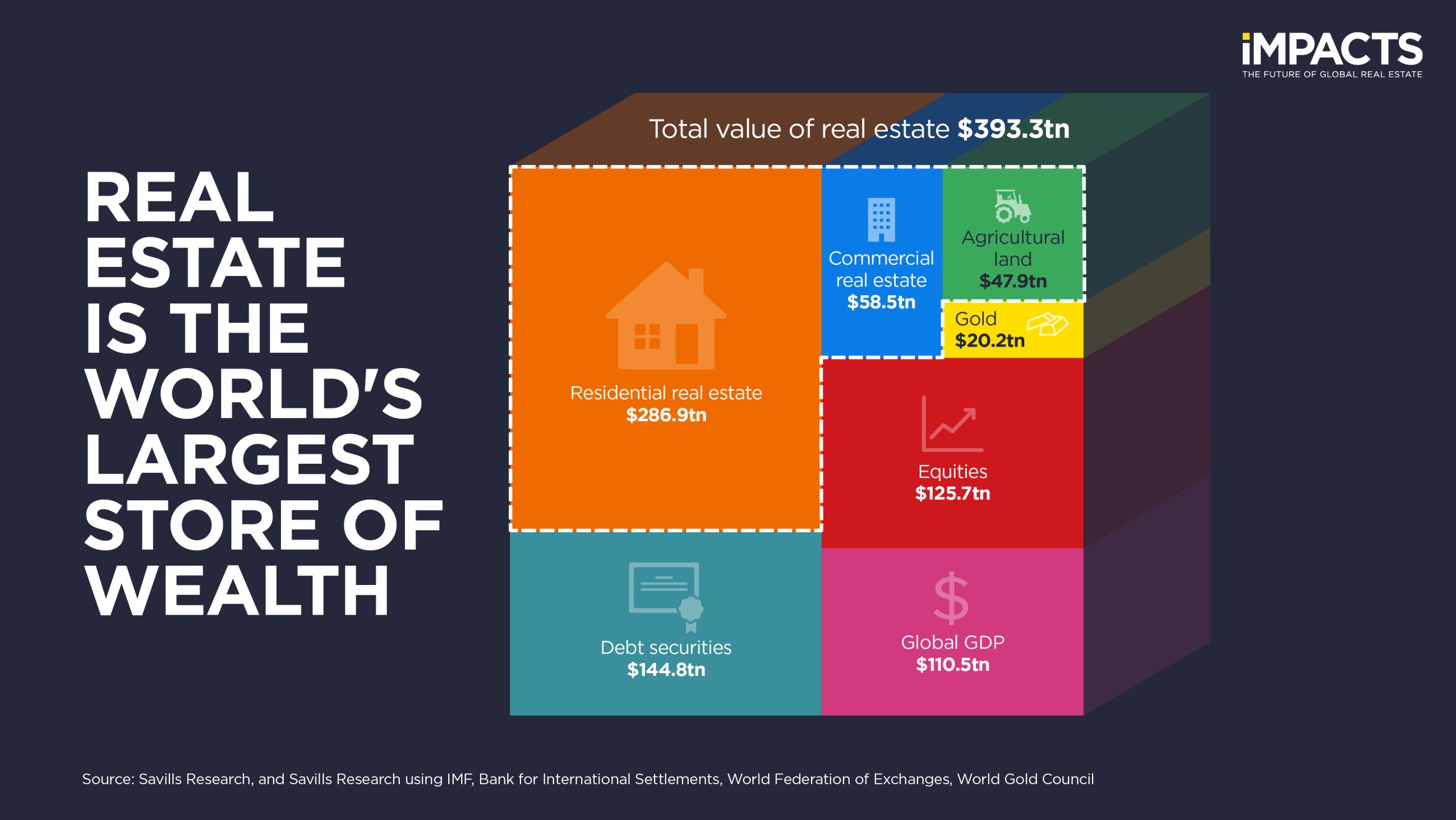

At the end of 2024, global real estate was valued at $393.3 trillion. Property continues to be the world’s largest asset class, surpassing the combined value of global equities and debt. To put this in perspective, all the gold ever mined equates to just 5% of real estate’s total worth.

However, the value of global real estate showed a slight decline of 0.5% in 2024, the result of a 2.7% fall in global residential property values. Most countries saw growth in residential values, supported by rising house prices and new housing supply. But falling property values in China, which accounts for a quarter of global residential value, dragged down the global average.

Commercial real estate and agricultural land values see strong growth

Commercial real estate value rose 4.1% year-on-year to $58.5 trillion, supported by new development and stabilising property prices. Some markets, such as the US, were buoyed by increased investment in manufacturing facilities as part of onshoring initiatives. These figures cover the full real estate spectrum, including more illiquid assets such as schools, civic buildings and hospitals – not just those held by institutional investors.

Agricultural land value jumped 7.9% in 2024, reaching $47.9 trillion. Population growth and increased per capita food consumption continue to drive demand for food, fibre and fuel, sustaining land value appreciation. At the same time, urbanisation and the degradation of productive land are adversely affecting supply.

Five-year growth trends and regional performance

While 2024 saw a modest decline in global real estate value, the five-year picture tells a different story. Since 2019, its total value has increased by 21.3%, broadly in line with global GDP growth of 25.6% over the same period. However, equity markets and gold outperformed real estate with gains of 41.4% and 110.3% respectively. Gold benefited from its safe-haven status amid global uncertainty.

North America led regional growth over the same period, with total real estate value rising 44% between 2019 and 2024. This expansion, driven by new development and a strong US economy, increased the region’s share of global real estate value from 21% to 25%.

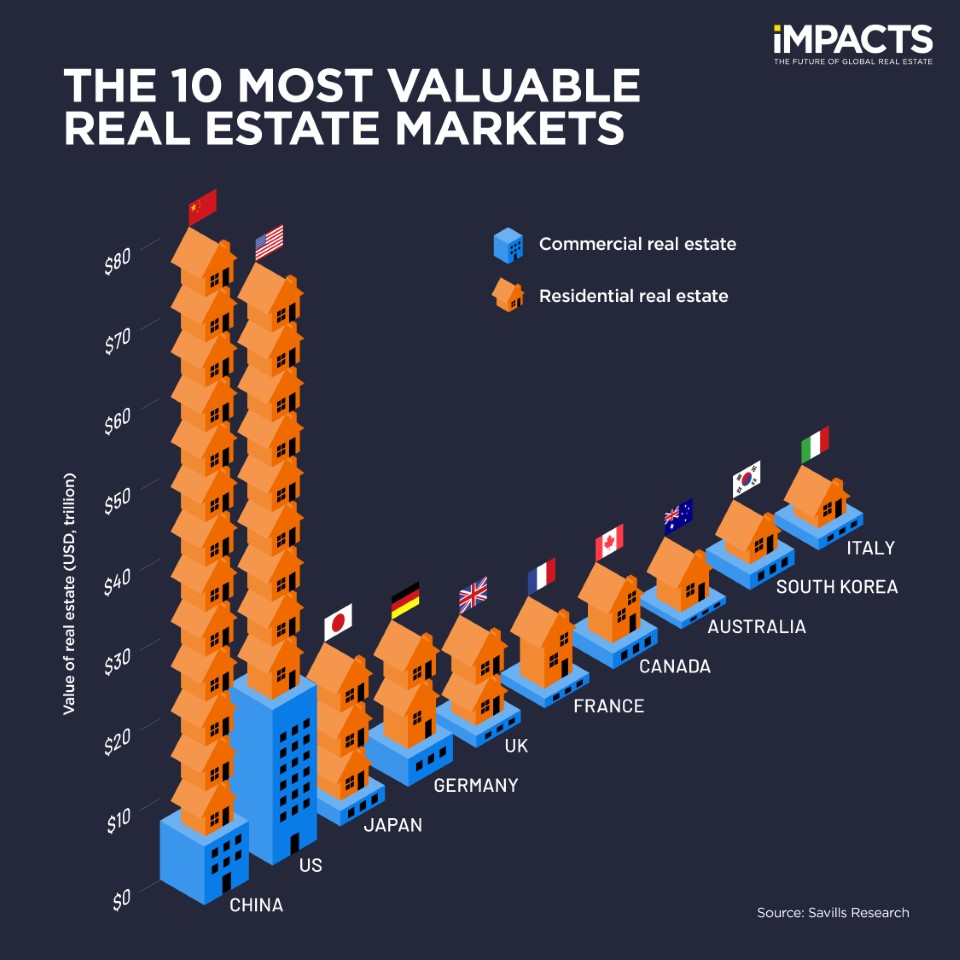

At a country level, China remains the world’s most valuable real estate market, accounting for 23.5% of global value, followed by the US at 20.7%. Japan, Germany, the UK, France, Canada, Australia, South Korea and Italy complete the top 10 markets, which together represent 71% of global value.

Global distribution of residential and commercial real estate value, 2024 vs 2019

Source: Savills Research. Asia Pacific excludes China and Hong Kong SAR, Africa excludes North Africa

Future outlook: real estate retains growth potential

Valued at three times global equity markets, real estate is set to remain the world’s most valuable asset class despite the recent slowdown in growth. Its scale is underpinned by the breadth of the residential sector, the stabilisation of commercial values and the need for ongoing development to support population and economic growth.

In the short term, elevated interest rates and affordability constraints are likely to temper the rate of residential value growth across many markets. China’s housing market reset will amplify this trend. However, efforts in many countries to expand housing supply – as the delivery of homes receives greater political impetus – may help offset it.

Meanwhile, the commercial real estate sector is poised for further growth. Asset pricing is beginning to recover, while national strategies to strengthen domestic manufacturing in response to fragmented global supply chains are driving new development. Extensive data centre construction to support AI adoption provides additional momentum.

Agricultural land values are also set to see continued growth due to the finite nature of land and its critical role in climate resilience, carbon sequestration and global food security.

While the pace of growth may vary across sectors and geographies, the long-term fundamentals remain strong. Real estate’s role as a store of wealth, a driver of development and a reflection of global economic shifts ensures its continued prominence in an evolving investment landscape.