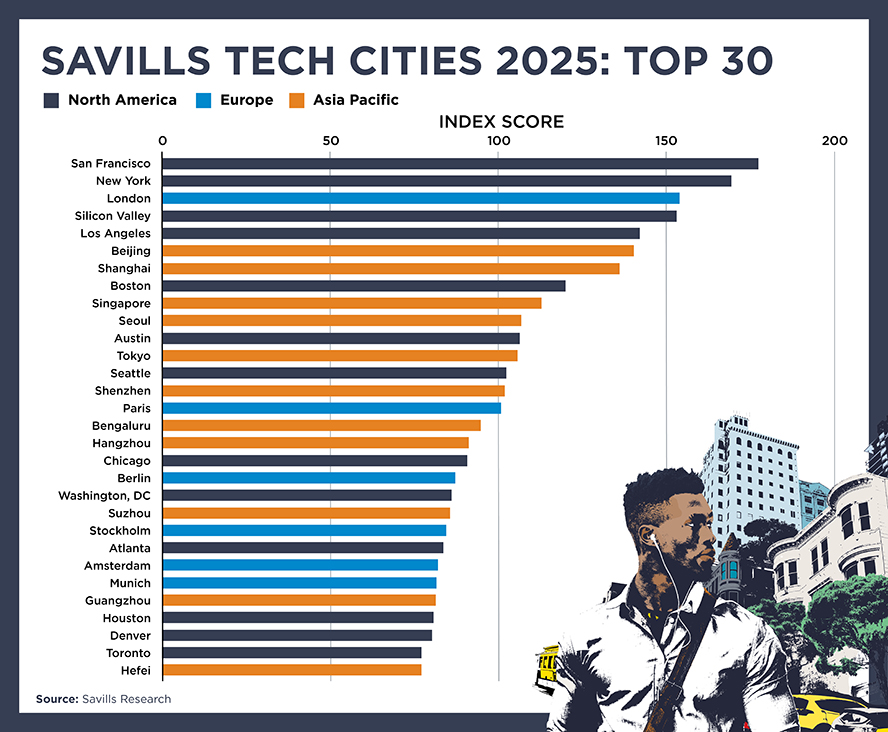

The Savills Tech Cities Index analyses the dynamic urban hubs that attract technology talent and investment and power the global tech ecosystem. Launched in 2015, our Tech Cities programme has today grown to cover 100 cities worldwide, reflecting the tech sector’s expanding footprint. The 2025 index arrives as the industry undergoes a major transformation, with AI now accounting for half of all venture capital investment.

How the Tech Cities Index works

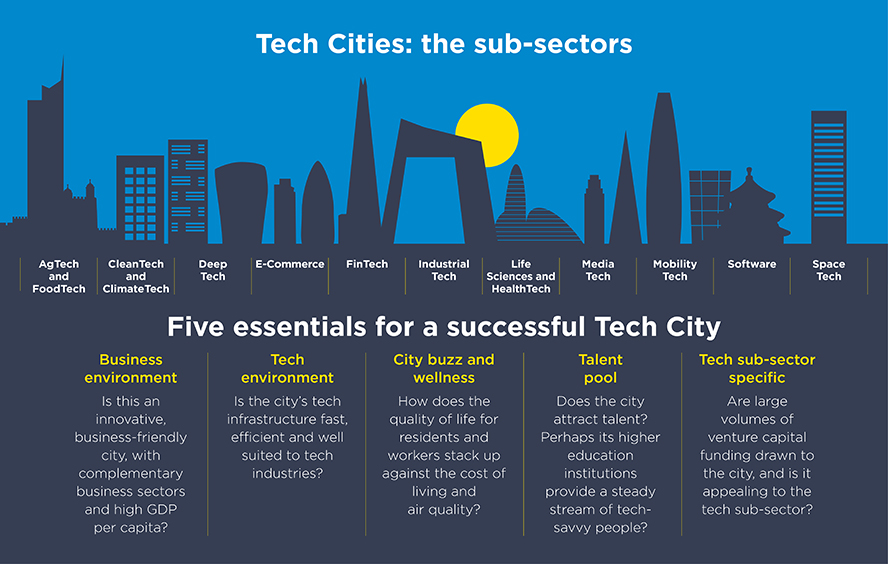

The index ranks cities across five pillars: business environment; tech environment; city buzz and wellness; talent pool; and the strength, diversity and depth of tech sub-sectors. The top-performing cities are hotspots for venture capital and host a broad spectrum of tech specialisms. The implications for real estate are clear: cities with a high concentration of tech firms experience strong office demand and have housing markets shaped by the needs of a skilled, mobile workforce.

Tech talent pools matter more than ever

Human capital is still tech’s most important asset, so a city’s attractiveness to skilled workers matters. The best-performing Tech Cities provide vibrant urban living with cultural and lifestyle offerings, often in walkable environments. Many smaller cities – by global standards – punch above their weight, especially those with more accessible housing and easy access to nature and outdoor activities.

However, the biggest cities continue to dominate. The 2025 index thanks to their diverse offer and broad business base. And crucially in an era of advanced technologies, these cities provide access to the deepest talent pools. Those with more than five universities in the global top 500 have risen an average of three places in the index since 2023.

San Francisco: the world’s AI capital leads our index

San Francisco retains the top spot in the 2025 Savills Tech Cities Index, having emerged as the global epicentre for AI. Despite a slow return to the office, demand is above the five-year average, reflecting renewed confidence in the city’s tech ecosystem. Top-tier prime office rents have risen 10.5% over the past two years, with the tech industry accounting for 70% of the largest deals for new office leasing activity.

“While the dot-com boom was rooted in Silicon Valley, today’s AI revolution has its epicentre in San Francisco. A powerful mix of world-class talent and plentiful venture capital has turned San Francisco into a new engine of growth, just as efforts to revitalise its urban environment begin to show results,” says Steve Barker, Vice Chairman, Savills San Francisco. “Leasing activity by AI firms is surging to record highs, yet overall office availability remains near historic peaks, signalling that a full office market equilibrium is still some way off.”

Transatlantic tech capitals hold their ground

New York maintains second place. A diversified tech hub, it benefits from a deep talent base and complementary industries. More broadly, the US continues to dominate global tech: American cities make up half of our top 10 and 40% of the top 30.

London moves up one position to third. Its high concentration of top-ranked universities – the most of any city – spur innovation and produce highly skilled graduates. London has particular strengths in FinTech, CleanTech and recently DeepTech and AI, helping it attract more venture capital than any other European city.

“London remains a top choice for global tech occupiers, whether they are homegrown firms or international players seeking a European HQ,” says Andrew Barnes, Director, Central London Office Leasing, Savills. “It offers access to a well-qualified, experienced and English-speaking tech labour market, broader than many other European centres and is often more cost-effective than in US cities.

“As well as an extensive transport network, London has a wide range of quality office stock across well-connected sub-markets, giving flexibility to firms looking to scale up.”

Asian cities surge up the rankings

Singapore rises three places to ninth, powered by political and regulatory stability, world-class infrastructure and a strong business environment. Seoul, now 10th, climbed four places thanks to rising wealth, net migration and expanded government support for AI, semiconductors, quantum computing and biotech. Both cities have low office vacancy rates and limited supply, which has driven up rents.

Elsewhere in Asia, six Chinese cities rank in the top 30. Beijing (sixth) and Shanghai (seventh) lead, followed by Shenzhen (14th), Hangzhou (17th) and emerging hubs such as Suzhou (21st) and Hefei (30th). China’s tech cities benefit from a vast domestic market and increasingly mature homegrown ecosystems.

The rising tech hubs of Europe and the Middle East

In addition to London, a number of other European cities have a strong global standing. Those in the top 30 include Paris (15th), Berlin (19th), Stockholm (22nd), Amsterdam (24th) and Munich (25th). Amsterdam, up five places, has seen VC funding for Deep Tech and FinTech more than double since 2023. The city’s tech industry is supported by a skilled, internationally oriented workforce with high English proficiency. Beyond the top 30, Barcelona (39th) and Madrid (45th) both climbed more than 10 places, driven by growing, skilled populations and a strengthening Spanish economy.

And in the Middle East, Dubai rose 20 places to 43rd, propelled by AI strategies alongside rapid population and business growth and the city’s attractive lifestyle.